Have you thought about a loan to install solar panels at your business?

Find out what the banks are offering…

According to an article from Business Insider, several South African banks are offering incentives for businesses and small companies to install Solar PV panels.

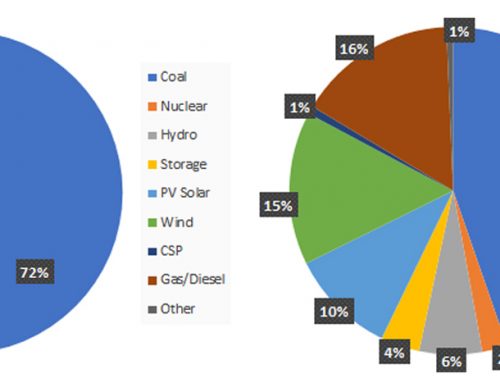

Due to the possible Eskom threat of stage 8 load shedding, more businesses around South Africa are looking for alternative sources of power to ensure consistent productivity. But not everyone has the finance at hand to cover the initial costs of installing a Solar Photovoltaic (solar PV) system.

With commercial tariffs costing between 85c and R1.70 per kWh and residential tariffs as much as R2.20 per kWh, a growing number of banks are offering incentives for businesses and small companies to install Solar Photovoltaic (solar PV) panels.

Although upfront costs are not always a barrier in the South African market where you may find a number of innovative financial mechanisms to complement your solar needs that require no initial capital from the client. An example being power purchase agreements which allow consumers to buy electricity per unit as they do from Eskom at a set price for between 12 and 15 years. Not everyone wants to use this option and would prefer outright ownership of their Solar PV Plant.

A medium-sized commercial system, perhaps 250kWp, could cost around R3.2 million, excluding battery costs which works out to roughly R0.90 per kWh for the next 15 years. It is also important to note that solar panels are VAT deductible, and could qualify for a 12b tax benefit that could result in additional savings of 28% on cost.

Let’s take a look at what each bank could offer:

| ABSA | NEDBANK | STANDARD BANK | FNB | |

| LOAN OFFERED | Scheduled repayments at up to 100% loan-to-cost. | – 60% company debt, and 40% equity from the bank.

– Asset Based Finance and Term Loans up to 100% of project cost. |

– Depending on borrower’s financial position, the bank will consider funding up to 100% of the installation costs.

– Scheduled repayments. |

Up to R50 million for a period of 10 years. |

| SECURITY REQUIRED | Project-specific and additional security might not be required. The installation is seen as part of the collateral. | Security can be taken against the asset but often is taken against the underlying balance sheet of the client. | Collateral-based contractual agreement. | Utilizing equity in commercial property as collateral. |

| LIMITATIONS | Individual projects as small as 30 kWp and up to 1 MW. | No minimum size, but Nedbank must be the sole primary banker. | Typical finance for projects up to 999kWp. Larger investments are evaluated on a case by case basis. | – |

| TERM OF DEBT | 5 – 10 years | Up to 10 years. | Up to 10 years. | Up to 10 years. |

| INTEREST RATE | Risk Dependant | Risk Dependant | Risk Dependant | Risk Dependant |