Financial Benefits of a Commercial PV Solar Plant

Generally these days, when discussing photovoltaic solar plants, many people will immediately highlight the “green” benefits and how renewable energy can help to save the environment. While those points are without doubt important and true, there are also a whole host of tangible financial benefits that will result from adding a PV Solar plant to your business.

With the quality of photovoltaic equipment improving and costs decreasing along with the sharply escalating electricity costs in South Africa, right now could be the ideal time to capitalise on an ever-expanding sector.

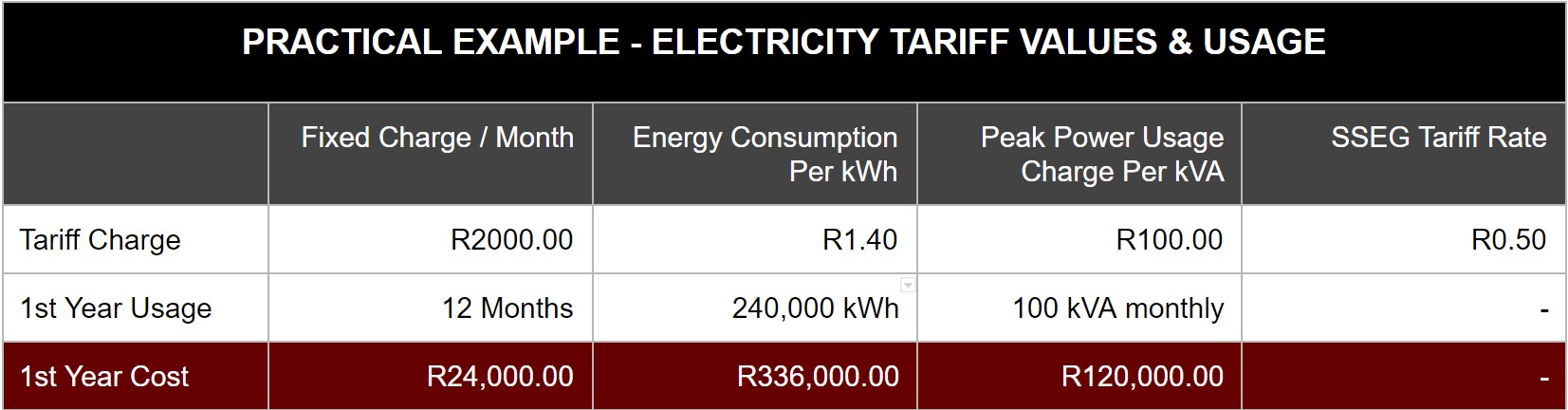

This article details the financial benefits of PV Solar using a basic, practical example: assessing the impact of a 100kWp PV Solar Plant ( generating 160,000 kWh per year ) on a business in South Africa currently spending an average of R 40,000.00 per month ( R480,000.00 per year ) on electricity bills. This example will be using the variables in the table hereunder as electricity usage and tariff values throughout this article. These values are similar to existing municipal tariffs. With over 200 Municipalities in South Africa, each with multiple commercial tariffs, forecasted PV Solar savings will inevitably vary on a project to project basis.

1. Energy Savings

Energy consumption on electricity bills is measured in kiloWatt hours ( kWh ) and in most billing cases in South Africa will equate to the highest percentage of costs on a commercial operations electricity bill.

Grid-tied PV Solar Plants generate energy when the sun is up, and a business will consume this generated energy first, with any additional energy required being supplied by the electrical grid. This results in the total energy consumption reflected on the electricity bill being reduced by the generated energy consumed from the PV Solar Plant.

Most commercial and industrial operations in South Africa are only fully operational during working hours. These working hours are generally from Monday to Friday from 8 in the morning to 5 in the evening, with a potential half day on Saturday. This generally results in far less energy consumption during weekends, public holidays and December shutdown periods. The PV Solar Plant will still be generating energy during these periods, and without the implementation of battery storage, this energy would need to be either curtailed ( where the solar inverters “slow down” to only supply the energy being consumed ) or exported to the electrical grid ( see SSEG savings – point 3 ).

The 100kWp PV Solar Plant is generating 160000 kWh of energy in a year, assuming 80% of this energy is self consumed and the energy billing charge in the first year per kWh is R1.40. The energy savings for the first year of the PV Plants operation will be R179,200.00.

2. Demand Savings

A majority of the municipalities in South Africa charge commercial customers for the peak 30 minute power ( measured in kVA ) recorded within the billing period. This amount can sometimes be quite rough on smaller businesses as even in a lower energy consumption month this amount can still be high due to short periods of high electricity usage.

Whilst demand savings will occur after the implementation of PV Solar ( as long as peak 30 minute periods fall in daylight hours ), these savings are impossible to accurately forecast due to the inevitability of inclement weather. It is in our experience with our existing clients that correctly sized PV Solar Plants can reduce the peak demand recorded by anywhere between 5% and 50% depending on the weather conditions during a billing period.

Whilst it is impossible to forecast the exact change to the peak demand, for our practical example we will assume that the 100 kWp PV Solar Plant results in an average of 15% reduction in the demand charge per month in the first year, this will result in a demand saving of R18,000.00 in the first year.

3. SSEG ( Feed In Tariff ) Savings

ESKOM and an ever-increasing number of municipalities offer an option to “sell” generated energy back to the electrical grid at a rate known as a Small Scale Embedded Generation Tariff ( or Feed In Tariff ).

The tariff value does vary quite substantially from municipality to municipality, but this tariff often allows for a tangible option for the excess energy generated on weekends to be beneficial without having to incur the high costs of battery storage.

Let’s assume the example 100kWp PV Solar Plant is situated in a municipality that offers a feed in tariff of R0.50 per kWh. The 20% of generated energy that was not self consumed would then result in additional savings of R16,000.00 in the first year of operation.

4. Carbon Tax Savings ( future benefit )

The South African Carbon Tax has been set in place by the government to fulfill the Paris Agreement. Essentially, every industrial company will be required to pay carbon tax in South Africa.

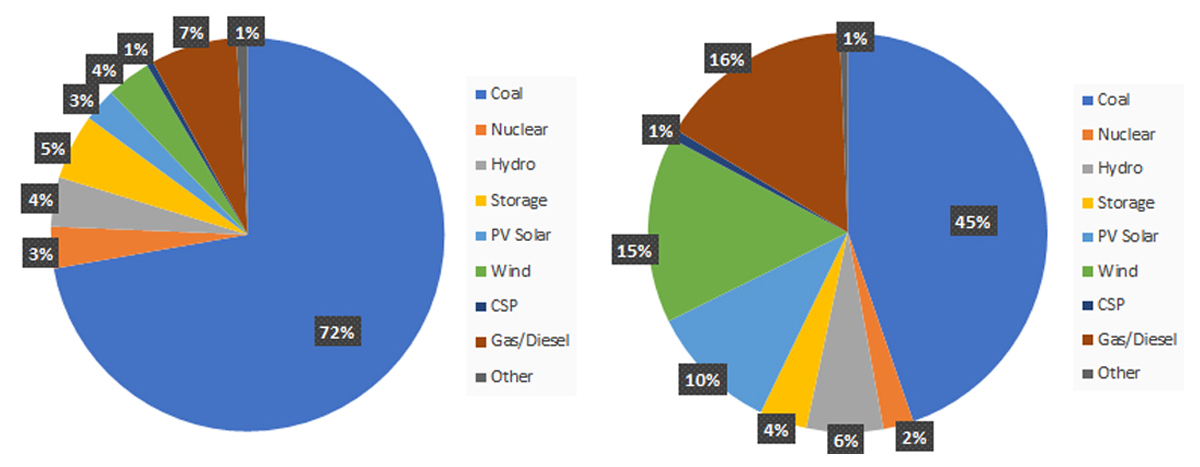

Officially, the carbon tax is set at R120 / ton of CO2-equivalent. However, there is a transitional period until the tax is set to take full effect in 2022. During that transitional period, there is a tax-free allowance of 70%. Saying this, if your business doesn’t start preparing for the realities of carbon tax going forward, this could greatly impact your profits.

Solar power saves money by reducing dependence on the electricity grid, but it also helps reduce your carbon footprint. This is an important part of helping the environment by reducing CO2 emissions and conserving resources through renewable energy.

It is not possible to accurately gauge the long term tax savings of PV Solar Plants. It is possible however to work out the impact of a PV Solar Plant on a business’ carbon footprint.

Using ESKOM’s emission factor, the 100 kWp PV Solar Plant will result in an emission reduction of 164.8 tonnes of CO2 in the first year of operation. Resulting in a first year potential offset against carbon tax of R19,776.00 ( assuming 100% Carbon Tax in effect )

5. Taxable Offset in the 1st Year

As from 1 January 2016, Section 12b of the Income Tax Act (South Africa) was amended from a three-year (50% – 30% – 20%) accelerated depreciation allowance on renewable energy to an even quicker depreciation allowance of ONE year (100%).

This accelerated depreciation allowance came about from a proposal in the 2015 draft Taxation Laws Amendment Bill that the definition of solar energy be amended to distinguish between photo-voltaic solar energy of more than 1 megawatt AC, photo-voltaic solar energy of less than 1 megawatt AC and concentrated solar energy. The amended Section 12b provision now provides for an accelerated capital allowance of 100% in the first year, in respect of photovoltaic solar energy of less than 1 megawatt.

The reason for the change is to accelerate and incentivise the development of smaller photo-voltaic solar energy projects, as these have a lower impact on water and environmental consumption. This is also intended to help address the energy shortages facing South Africa in a more environmentally friendly way.

Section 12B of the Income Tax Act No. 58 of 1962, as amended (the ‘Act’), provides for a capital allowance for movable assets used in the production of renewable energy. More specifically, it allows for a deduction equal to 100% basis in respect of any plant or machinery brought into use in a year of assessment for the first time and used in a process of manufacture or any other process which is of a similar nature. It is important to note that the allowance is only available if the asset is brought into use for the first time by the taxpayer. In other words, the allowance is not limited to new or unused assets. The wording merely prevents the taxpayer from claiming the section 12B allowance twice on the same asset.

Currently, company tax in South-Africa is 28%. With this incentive, you can deduct the value of your Power Plant as a depreciation expense from your companies’ profits. This means that your company’s income tax liability will be decreased by the same value as the value of the installed solar system. This reduction can also be carried over to the next financial year as a deferred tax asset. In effect, it is the same as getting a 28% discount on the price of your solar system.

6. Electricity Escalation

In the last 50 years, including 2020’s increase of 8.76%, ESKOM’s average price increase per year since 1971 has been 11.09%.

Judging by the existing trends and the current economic and political climate in South Africa we can realistically assume that this escalation is not going to drop off during the lifespan of a PV Solar Project. To keep our financial values realistic, we will work our example on an average yearly escalation of 11.09%. Should this number turn out to be higher it would greatly increase the long term savings of a PV Solar Plant.

So How Much Will You Actually Save?

So if we look at our example: Prior to the 100kWp Solar Plant being installed, the annual electricity bill of the example was R480,000.00. With the combined savings ( energy, demand and SSEG ), that amount has dropped to R266,800.00, a saving of 44.4%.

I’m sure by this stage in the article you are probably wondering how much money you will need to spend in order to reap the aforementioned financial benefits, and more importantly whether this investment will make sense in both the short term and long term.

PV Solar Plants will always vary in cost depending on a wide range of factors. These factors include geographical location, roof profile, size of plant, voltage of tie-in, and exchange rates, just to name a few.

For the sake of simplicity we will assume the full turnkey cost of the 100kWp PV Solar Plant will be R1.2 million. This equates to less than the combined cost of 3 years of current electricity bills, which is more often than not the case with commercial and industrial PV Solar Plants.

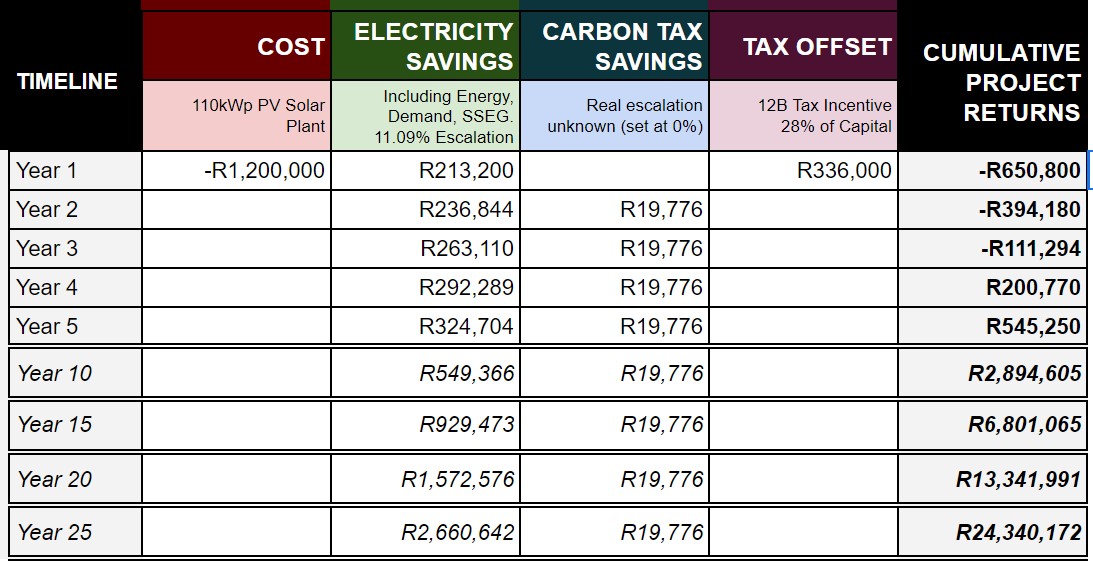

Hereunder see the savings impact of our practical example in a basic cash flow:

In under 3 and a half years, investment has paid for itself. With current photovoltaic technology and a trusted operation and maintenance contract, the expected lifespan of solar plants being constructed today is in excess of 35 years.

Should you require a proposal to see the financial benefits that a photovoltaic solar plant can have on your business, please do not hesitate to click on the button below.